Startup equipment financing bad credit

This financing option helps launch your business from ideation to establishment. A startup business loan is any type of financing available to businesses with little to no history.

Start Up Business Loans Bad Credit And No Collateral Lantern By Sofi

With equipment financing the piece of equipment youre purchasing acts as collateral for the loan.

. You will have to be at least 18 years of age a US. If you have bad credit business financing options like equipment financing invoice financing and merchant cash advances will probably be your best bet. Youll need at least two years in business 100000 in annual revenue and a minimum credit score of 680.

Tractor financing rates start at 5 per year. Discover what entrepreneurs need to know to get a startup business loan. Traditional business loans have a 67 approval rate.

With this small business funding option you can finance large equipment purchases. Lendio states that if you have bad credit but can show solid revenues for the past 3-6 months you can qualify for equipment financing. Citizen or permanent resident with a valid Social Security number regular income a home or cellphone number and a valid checking account.

Pre-opening startup costs include a business plan research expenses borrowing costs and expenses for. Get a great deal on a great car and all the information you need to make a smart purchase. Best Small Business Funding Options.

Auto and equipment loans have an 80 approval rate. Financing rates for tractors can go up from there based on your credit time in business and other factors. Give your new business a boost in 2018 with a startup loan.

Unbeatable low rates on equipment. NW IR-6526 Washington DC 20224. The dot-com bubble also known as the dot-com boom the tech bubble and the Internet bubble was a stock market bubble in the late 1990s a period of massive growth in the use and adoption of the Internet.

Even if you have bad credit below 600 you still qualify for a business loan. Between 1995 and its peak in March 2000 the Nasdaq Composite stock market index rose 400 only to fall 78 from its peak by October 2002 giving up all its gains during. With equipment loans you can finance up to 100 of the cost of the equipment you need.

Luckily you can use equipment financing as a startup loan to help you pay for these costs. Weve developed a suite of premium Outlook features for people with advanced email and calendar needs. Find new and used cars for sale on Microsoft Start Autos.

You can choose from financing options including short term loans SBA loans equipment loans lines of credit and much more. Rental price 70 per night. As the name implies this company focuses exclusively on PO financing offering up to 100 funding of your supplier costs for amounts of 500000 to 25.

GPS coordinates of the accommodation Latitude 43825N BANDOL T2 of 36 m2 for 3 people max in a villa with garden and swimming pool to be shared with the owners 5 mins from the coastal path. The amount you get for the loan depends on the value of the. SBA loans or lines of credit have a 52 approval rate.

Bank of America has the lowest interest rates weve seen on equipment financing. You can send us comments through IRSgovFormCommentsOr you can write to the Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave. Startup businesses or those with very poor credit may see much higher rates.

Its an attractive financing. It offers a low standard starting rate and you can get an even better rate by participating in Bank of Americas loyalty program. Personal loans have a 55 approval rate.

BillsHappen can match you to a direct lender in less than five minutes for loans of up to 5000 no matter what your credit score. Youll need at least two months of invoicing history and at least 100000 in annual revenue. Home equity lines of credit have a 70 approval rate.

The more you use Bank of America the higher interest rate discount you can get. We welcome your comments about this publication and your suggestions for future editions. Thus small business loans with no personal credit check turn out as the best alternative funding choice for bad credit business borrowers that are turned down by banks credit unions and other financial.

Startup business funding can be used to fund various new business initiatives. A Microsoft 365 subscription offers an ad-free interface custom domains enhanced security options the full desktop version of Office and 1. Best Startup Business Loans.

If you have a startup with bad credit consider a financing alternative like a business credit card or where appropriate a merchant cash advance or invoice factoring. Getting Start Up Business Loans with Bad Credit and No Collateral Before you start to apply for unsecured startup business loans it can help to do some prep work to strengthen your pitch. Disaster relief long-term loans real estate loans equipment financing and more.

Our suite of lending products includes small business loans bad credit business loans working capital loans equipment financing merchant cash advances business line of credit and well work with you to determine which option is best for your situation. Besides the application process for loans without credit check is really simple and short ensuring fast access to business funding. Learn more about startup loans here and explore options from 75 best-in-class lenders.

Fundbox is one of a handful of alternative lenders that offers invoice financing with no hard credit check until you know your credit limit and fees. Business lines of credit have a 73 approval rate. Get all the latest India news ipo bse business news commodity only on Moneycontrol.

Mortgages have a 69 approval rate. In general invoice financing can be a good option for business owners with bad credit. Nevertheless you are not out of luck if you have a bad credit score.

Startup costs are the expenses incurred during the process of creating a new business. Even with bad credit you can present an in-depth business plan that outlines your strategies for success and how you plan to use the funding. Lendios network includes more than 75 lenders including big names such as Kabbage Funding OnDeck Amex and BlueVine.

A variety of business loans and financing methods are available to startupsincluding SBA microloans asset-based loans business credit cards and morealthough it can be difficult for new small businesses to access funding. But their qualifications are strict. We survey more than 200 private equity PE managers from firms with 19 trillion of assets under management AUM about their portfolio performance decision-making and activities during the Covid-19 pandemic.

Top 10 Startup Loans For Small Businesses With Bad Credit In 2022

Commercial Truck Financing With Good Bad Credit Truck Loans

9 Startup Business Loans For Bad Credit 2022 Badcredit Org

Guide To Equipment Loans Leases For Startup Businesses

9 Startup Business Loans For Bad Credit 2022 Badcredit Org

Can You Get A Business Loan With Bad Credit Bplans

Heavy Equipment Financing Bad Credit 2022 17 Options

Best Equipment Financing Fast Approvals Up To 500k

6 Best Equipment Loans For A Startup Business

How To Get A Startup Business Loan With Bad Credit In 2022

Micro Business Loans For Business Owners With Bad Credit Clear Skies Capital

![]()

Business Loans For Equipment Loans Canada

![]()

Business Loans For Equipment Loans Canada

How To Get A Business Loan With Bad Credit Forbes Advisor

8 Ways To Get Equipment Financing With Bad Credit Lantern Credit Lantern By Sofi

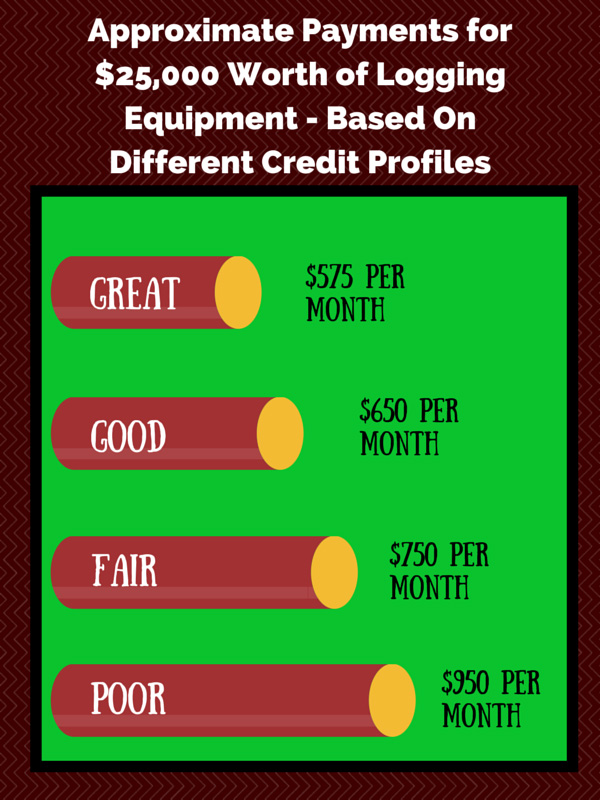

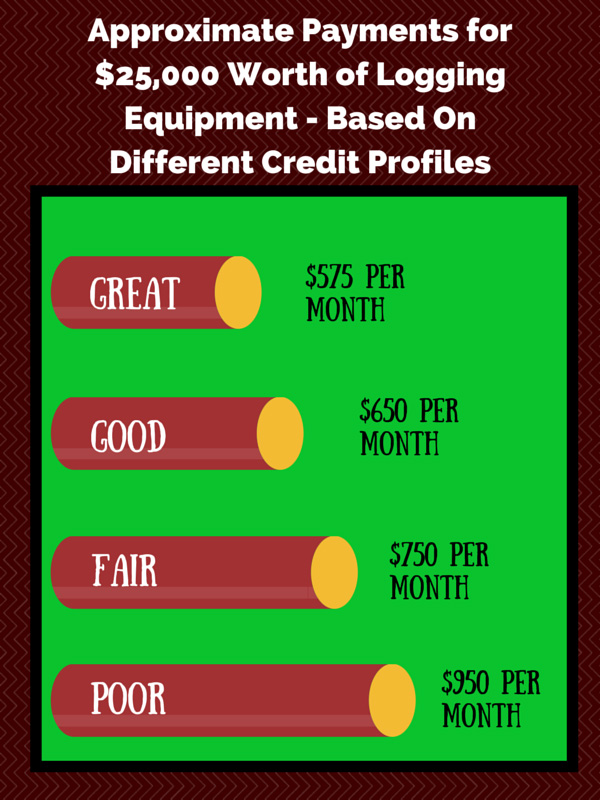

Can You Qualify For Logging Equipment Financing

Restaurant Equipment Leasing For Startups The Restaurant Warehouse